Micro and Small Enterprise Development

Micro and Small Enterprise Development

- Published: 19 August 2011

- Hits: 26779

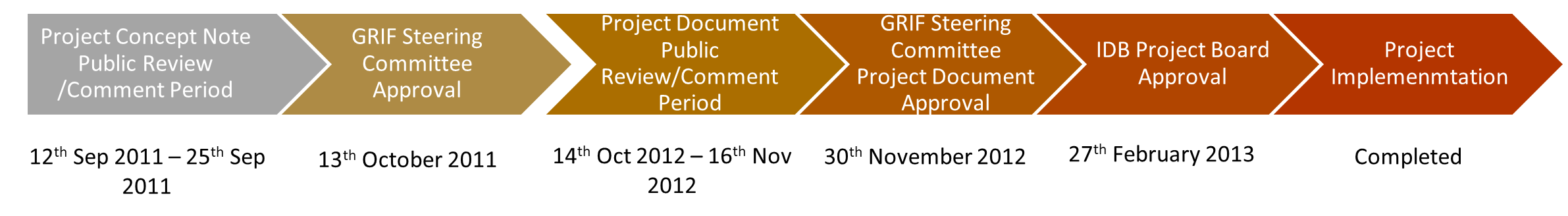

Project Timeline

Quick Facts

Total Project Budget: US$ 5 Million

Partner Entity:

Implementing Agency: Small Business Bureau, Ministry of Business

Project Background and Summary

This Micro and Small Enterprise Development (MSE) Project aims to address two of the major bottlenecks that constrain the development of MSEs and the ability of vulnerable groups to build alternative livelihoods in Guyana, which are i) limited access to finance and ii) limited technical and business skills.

Access to finance is addressed through a credit guarantee facility; an interest payment support facility; and a low carbon grant scheme to assist vulnerable persons with viable business propositions in low carbon sectors. The Small Business Bureau works with Partner Financial Institutions, currently Republic Bank Ltd. (RBL), Guyana Bank for Trade and Industry (GBTI), and the Institute for Private Enterprise Development (IPED), to facilitate the loan process. With respect to the commercial banks, RBL and GBTI, that are Partner Financial Institutions, the Government of Guyana has granted concessions to these institutions under the project to reduce interest rates to 6% for all loans under the MSE project.

Lack of skills is addressed through a training voucher scheme which will enable MSEs to obtain the skills they require at existing training institutions free of cost to them. The project targets MSEs who are in or who wish to transition to low carbon sectors.

The low carbon sectors identified for funding under the project are: fruits and vegetables (farming and processing); aquaculture; eco-tourism; business process outsourcing; bio-ethanol; energy efficient transportation and logistics; low carbon manufacturing activities; low carbon agriculture and agro-processing; apiculture; low carbon energy production and/or distribution; professional and business services; internet and computer based services; entertainment, music and performing arts; arts and crafts; and publishing and printing.

Status Update

Under the MSE project two hundred and twenty four (224) loans were approved for beneficiaries in low carbon sectors at a total approximate value of US$ 4,399,138 (G$ 908,422,000). Under the grant component of the project five hundred and tninety one (591) grants were approved for entrepreneurs, including those from vulnerable groups, under the project at an approximate value of US$ 891,055 (G$ 184,002,830). It is estimated that approximately two thousand one hundred and one (2,101) jobs have been created and or sustained from these loans and grants.

Additionally, four thousand four hundred and eighty two (4,482) persons were trained free of cost in several areas, including: basic business management skills, record keeping, packaging and labelling, a special course aimed at female entrepreneurs, climate smart agriculture, sustainabale forestry, sustainable mining, videography, photography, cosmetology, cookery, and craft.

Relevant Documents

MSE Project Concept Note

MSE Project Concept Note MSE Admin Fees Request

MSE Admin Fees Request MSE Project Concept Note - Record of Decision

MSE Project Concept Note - Record of Decision MSE Project Document Final

MSE Project Document Final MSE Project Document - Record of Decision

MSE Project Document - Record of Decision MSE Mid-term Evaluation

MSE Mid-term Evaluation

________________________________________________________________________________

| Partner Entities | Implementing Agencies |

| Inter-American Development Bank | Small Business Bureau - Ministry of Business |

| United Nations Development Programme | Ministry of Agriculture |

| United Nations Environmental Programme | Ministry of Indigenous Peoples’ Affairs |

| Food and Agriculture Organisation of the United Nations | Guyana Forestry Commission |

| World Bank |

Low Carbon Development Strategy